There is no question the holidays are a stressful and harried time of year. We surround ourselves with the spirit of the season and strive (sometimes even unrealistically) to celebrate to the fullest by attending events with friends and family. The last thing we want is to add “market performance” to our list of concerns. While it is true that the markets have been negative for the last three months, it is not an indication that you are on Santa’s “Naughty List.”

The performance of markets can vary widely in short periods such as day-to-day and month-to-month. Volatility is expected. For example, in 2009 the S&P 500 had a calendar year return of 26.46%. The largest intra-year decline in 2009 was -27.19% (from January 7 to March 9) while the largest intra-year gain in 2009 was 69.66% (from March 10 to December 28). Short-term price movements are impossible to predict and can change when least expected.

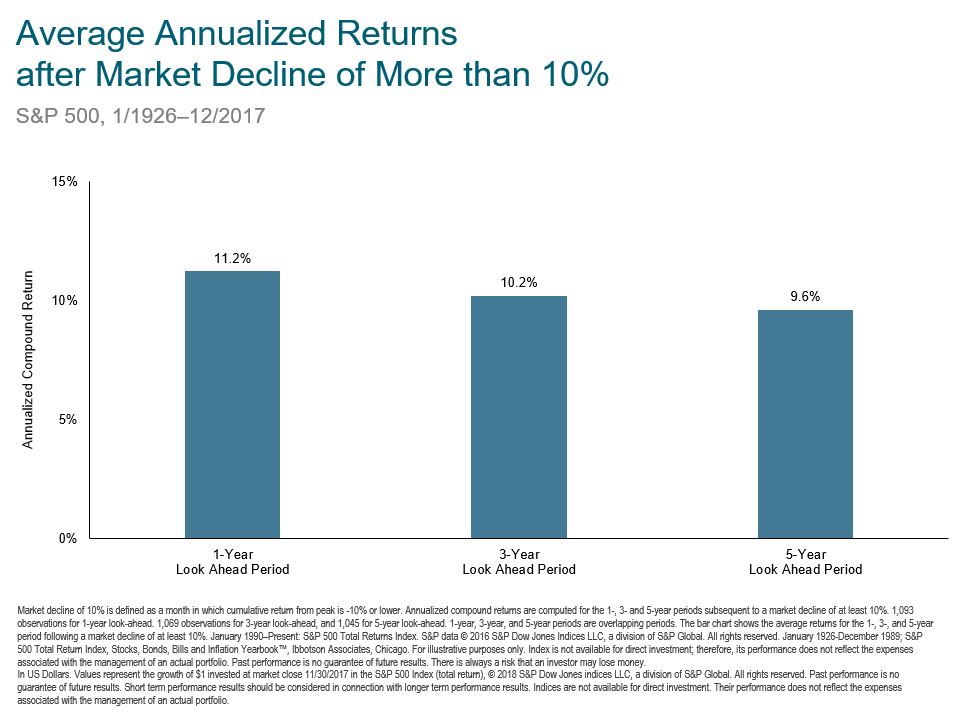

The chart below illustrates this well. As you can see, the S&P 500, after suffering a decline of 10% or more, had positive 1-year, 3-year, and 5-year returns going back all the way to 1926. History has shown us that patience in the market has historically been rewarded.

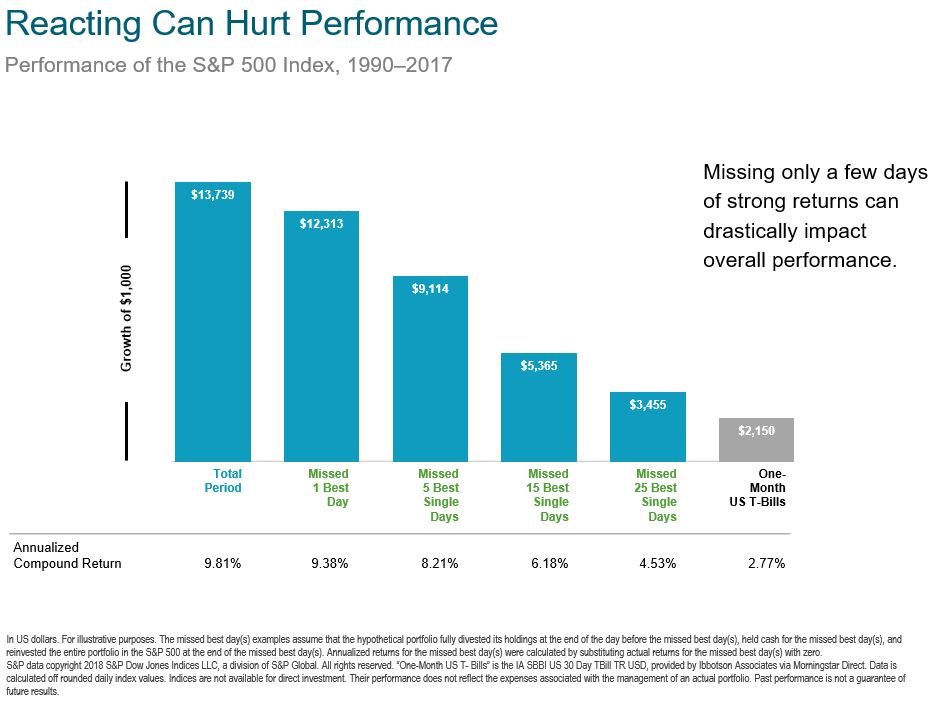

Emotionally reacting to this volatility can hurt your long-term performance.

So what are we doing in these markets? The answer is everything and nothing. As always, we continue to focus on the things we can control.

We are following your investment plan based on established market principles tailored to your specific needs and goals. We have developed a long-term financial plan for you that takes into account the kind of market fluctuations we are experiencing now. We continue to manage your portfolio with low expense investment products and low portfolio turnover while maintaining broad diversification. We continue to stay disciplined through various market conditions. We take advantage, where it makes sense, to purchase equities when they are down with new cash or by reinvesting dividends at lower prices. Where prudent, we are tax-loss harvesting with trades that will maintain your investment strategy but capture some tax-losses on paper to reduce your 2018 tax liability. In other words, we are constantly looking for opportunities to improve your financial situation during down markets.

The most common questions we receive right now focus on international markets and why we continue to hold those positions when they are down. We believe markets are efficient but returns are random. Since 2003, the MSCI Emerging Markets Index has been the top performing asset class in 8 out of the 14 consecutive years reviewed. While the domestic markets have had a spectacular showing recently, they embody only a few segments of investing. Further, the US markets represent only 54% of the world’s total stock market capitalization.

Worries about changes in trade policy and other economic concerns are clearly on the markets’ minds. We cannot predict interest rate changes, though we have structured the portfolios with the expectation that they will increase. No one can know how the China tariff situation or Britain leaving the E.U. will be resolved, but we do know that the markets will find new short-term worries to focus on once these issues are settled.

No one can know when we will enter a recession. In fact, the financial world only knows once it has already begun! What we do know is NOT reacting emotionally with major changes to your allocation has historically been the right course for long-term success.

We understand these adjustments may be painful and worrisome but they are just a planned piece of your financial puzzle. As always, if there is a change to your financial situation, we encourage you to contact us. If we do not hear from you, know that we feel privileged to be your advisor and never take for granted the trust you place in our firm. We wish you all the blessings and joy the holiday season affords and we look forward to working together in 2019.

Sincerely,

Verus Financial Partners

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Verus Financial Partners), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Verus Financial Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Verus Financial Partners is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Verus Financial Partners’ current written disclosure statement discussing our advisory services and fees is available upon request. If you are a Verus Financial Partners client, please remember to contact Verus Financial Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.